India Ratings & Research (Ind-Ra) has affirmed State Bank of India's (SBI) long-term issuer rating at 'AAA'. The outlook is stable. SBI's rating is driven by its quasi-sovereign risk status and huge systemic importance resulting in a high probability of extraordinary support from the government of India, if required. The rating is also driven by SBI's competitive edge as India's largest domestic bank with about 17% share in deposits and assets.

India Ratings & Research (Ind-Ra) has affirmed State Bank of India's (SBI) long-term issuer rating at 'AAA'. The outlook is stable. SBI's rating is driven by its quasi-sovereign risk status and huge systemic importance resulting in a high probability of extraordinary support from the government of India, if required. The rating is also driven by SBI's competitive edge as India's largest domestic bank with about 17% share in deposits and assets.

The bank has an extensive branch reach, strong deposit franchise, above-average capital ratios among government banks and better income diversity than most of them. The bank has 15,946 branches (Q1FYE15) spread widely across India and is a sole banker (providing organised credit) in many economically backward geographies of India. SBI is the lead banker in about a quarter of districts in India, a large proportion of which are economically under developed regions.

The bank has an extensive branch reach, strong deposit franchise, above-average capital ratios among government banks and better income diversity than most of them. The bank has 15,946 branches (Q1FYE15) spread widely across India and is a sole banker (providing organised credit) in many economically backward geographies of India. SBI is the lead banker in about a quarter of districts in India, a large proportion of which are economically under developed regions.

SBI's asset quality remains a concern as the incremental additions to stressed assets remain high. Although SBI's gross NPLs have been moderated through higher write-offs and sale to asset reconstruction companies, they remain among the highest in the system. The entire domestic portfolio except retail reflects elevated stress though NPLs are largely contributed by mid corporates, small and medium enterprises and agriculture.

The bank's increased focus on better-rated corporates should be asset quality positive in the medium-to-long term. Its higher growth in gold-backed agricultural loans should reduce delinquencies in the agriculture portfolio. Nevertheless, the impact of the lower-than-normal monsoon in 2014 and the impairment in credit culture in certain regions on the announcement of debt waiver schemes will remain an asset quality overhang. The phasing out of regulatory dispensation on restructuring from FY16 could bring forward some of the loans for restructuring. The bank is likely to continue to demonstrate greater cyclicality and higher-than-average delinquencies given some of the policy roles that it plays.

SBI's concentration of advances has increased in FY14 with the top 20 advances constituting 17.9% of the total loans (FY13: 10.4%) which increases single party concentration risk. The impact of the recent coal blocks cancellation on SBI’s asset quality is likely to be marginal in view of the bank’s modest exposure in the impacted corporates.

SBI's funding, the strongest in the system, is supported by its stable retail deposits franchise. The bank’s savings account ratio of 36.8% of domestic deposits (Q1FY15) is the highest among that of peers and is supported by its large pan-India branch network. Nevertheless, the pace of incremental growth of CASA deposits has declined and is lower than that of the banking system, primarily due to lower current account deposit growth.

The capital infusion of Rs 20 billion from the GoI and Rs 83 billion in the form of equity through capital market have strengthened the bank's core equity Tier 1 ratio (Q1FY15: 9.8%) which compares favourably with that of its peers. According to Ind-Ra's estimates, the bank might require up to Rs 1,303 billion of Tier 1 capital including Rs 832 billion of equity capital over Basel 3 transition period till FY19. The estimate of capital requirement has increased significantly as the internal accruals of the bank slid sharply in FY14. The bank, however, is better placed among other public sector banks to raise equity capital from the market.

SBI's focus on better rated clients and faster expansion in large corporates and international portfolio may have adversely impact its net interest margins. However, the impact on profitability may be cushioned by lower operating and credit costs.

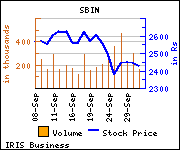

Shares of the bank declined Rs 19.35, or 0.79%, to settle at Rs 2,423. The total volume of shares traded was 167,688 at the BSE (Wednesday).