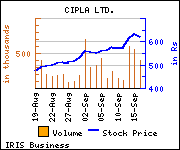

Nomura Financial Advisory and Securities has downgraded Cipla to 'Reduce' from 'Neutral' with target price of Rs 569 as against current market (CMP) of Rs 630 in its report.

Nomura Financial Advisory and Securities has downgraded Cipla to 'Reduce' from 'Neutral' with target price of Rs 569 as against current market (CMP) of Rs 630 in its report.

Commenting on investment rationale, Nomura said, "Cipla's stock trades at 35.7x FY15F and 26x FY16F EPS of Rs17.65 and Rs 24.27 respectively, a 30-45% premium to peers. The valuation seems expensive as we see limited upside risk to earnings in the near term. However, we don’t expect revenue composition to change significantly, and rise in R&D spend should result in limited EBITDA margin expansion.

Commenting on investment rationale, Nomura said, "Cipla's stock trades at 35.7x FY15F and 26x FY16F EPS of Rs17.65 and Rs 24.27 respectively, a 30-45% premium to peers. The valuation seems expensive as we see limited upside risk to earnings in the near term. However, we don’t expect revenue composition to change significantly, and rise in R&D spend should result in limited EBITDA margin expansion.

We believe investors expectations from Cipla’s inhaler franchise have raised after the recent launch of Seretide MDI in select EU markets. The approval is a positive development, but approvals for other high-value inhalers in the EU and the US still have significant regulatory challenges."

Disclaimer: IRIS has taken due care and caution in compilation of data for its web site. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.