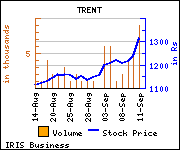

ICICIdirect recommends 'Accumulate' on Trent in the range of Rs 1,288-1,260 for a target of Rs 1,745 with a stop loss below Rs 1,095 on a closing basis against current market price of Rs 1,290 in its report.

Commenting on the investment rationale, the stock broker said, "The stock retraced its previous two month decline in just two weeks highlighting faster retracement of the most recent down leg, which is a sign of positive momentum returning in the stock leading it to break past the three year long consolidation. The current positive momentum is reflected by way of the bullish engulfing line pattern on the monthly time interval chart.

Commenting on the investment rationale, the stock broker said, "The stock retraced its previous two month decline in just two weeks highlighting faster retracement of the most recent down leg, which is a sign of positive momentum returning in the stock leading it to break past the three year long consolidation. The current positive momentum is reflected by way of the bullish engulfing line pattern on the monthly time interval chart.

We believe the stock is set for its next up leg within the larger up trend. The target price of Rs 1,745 is projected based on the past consolidation range of the past three years offering a favorable reward-risk equation."

Disclaimer: IRIS has taken due care and caution in compilation of data for its web site. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.