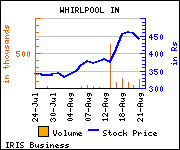

MICROSEC Capital recommends 'Strong Buy' on Whirlpool of India with a target price of Rs 580 a share i.e. an upside of 32% from the market price.

MICROSEC Capital recommends 'Strong Buy' on Whirlpool of India with a target price of Rs 580 a share i.e. an upside of 32% from the market price.

Commenting on the investment rationale, MICROSEC Capital, said, "Net Sales up by 19.2% YoY and 60.2% QoQ on launch of new products and better sales volume. Despite 15% increase in raw material cost which constitutes ~70% of the total expenditure, EBITDA grew by 57.4% YoY. It was up by 118.9% QoQ.

Commenting on the investment rationale, MICROSEC Capital, said, "Net Sales up by 19.2% YoY and 60.2% QoQ on launch of new products and better sales volume. Despite 15% increase in raw material cost which constitutes ~70% of the total expenditure, EBITDA grew by 57.4% YoY. It was up by 118.9% QoQ.

EBITDA margins expanded by 300bps YoY and by 350bps QoQ on better cost management. PAT excl exceptional items grew by 67.4% YoY and 133.5% QoQ on lower depreciation and interest cost.

The management has targeted up to 12% growth in turnover at Rs 37 billion in the current fiscal. Consequently, post this performance the company deserves a higher growth rate in future."

Disclaimer: IRIS has taken due care and caution in compilation of data for its web site. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.