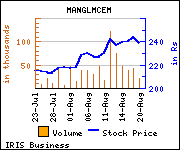

Karvy Institutional Equities India Research has recommended 'Buy' on Mangalam cement at target price Rs 330 compared to market price 246 on August 21.

Karvy Institutional Equities India Research has recommended 'Buy' on Mangalam cement at target price Rs 330 compared to market price 246 on August 21.

Commenting on the investment rationale ,Karvy, said "1QFY15 Net Sales rose 36% YoY to Rs 2.3 billion driven by 19% YoY sales volume & 15% YoY NSR growths. Strong demand in the northern region and production from the newly commissioned grinding unit boosted sales volume & pricing.

Commenting on the investment rationale ,Karvy, said "1QFY15 Net Sales rose 36% YoY to Rs 2.3 billion driven by 19% YoY sales volume & 15% YoY NSR growths. Strong demand in the northern region and production from the newly commissioned grinding unit boosted sales volume & pricing.

Clinker share in total sales volume stood at 6% in 1QFY15 vs 0% in 1QFY14 and 12% in 4QFY14. Blended NSR surged 11% QoQ on both strong price uptick & lower share of clinker sales QoQ.

Net sales came in 3% ahead of our estimates on account of 3% higher NSR vs our estimates.levels. We have lowered depreciation cost estimates by ~23-25% to factor in the change in depreciation policy thereby leading to 6-9% increase in our PAT estimates.

We re-iterate our BUY recommendation with a TP of Rs 330 valuing it at USD55 per MT on its 3.25 million MT capacity, 4.0x FY16E EBITDA and 2.7x its FY17E EBITDA. Our TP assumes 65% discount to benchmark replacement cost vs. its long term discount of 55% and last bull-cycle discount of 40%."