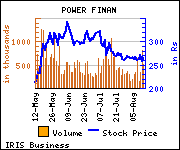

HDFC Securities has maintained 'Buy' on Power Finance Corporation (PFC) with revised target price of Rs 330 as against current market price (CMP) of Rs 266 in its report.

HDFC Securities has maintained 'Buy' on Power Finance Corporation (PFC) with revised target price of Rs 330 as against current market price (CMP) of Rs 266 in its report.

Commenting on the investment rationale, HDFC Securities said, ''PFC's core earnings were inline with estimates. However, with higher provisions (+42% YoY) reported net earnings were below estimates. G/NPA spiked 61/64% QoQ with two A/Cs of Rs 7.5 billion turning NPAs. Loan growth further moderated to 17% and NIM declined 20bps QoQ (impacted by higher CoF and interest reversals).

Commenting on the investment rationale, HDFC Securities said, ''PFC's core earnings were inline with estimates. However, with higher provisions (+42% YoY) reported net earnings were below estimates. G/NPA spiked 61/64% QoQ with two A/Cs of Rs 7.5 billion turning NPAs. Loan growth further moderated to 17% and NIM declined 20bps QoQ (impacted by higher CoF and interest reversals).

Reforms in power sector, robust O/S sanctions improve business visibility for PFC. NIM will remain healthy, despite factoring compression. With clarity on restructured assets provisions, we have increased our provisions estimate and thus lowered our earnings estimate.

While PFC would continue to deliver superior RoAA of 2.7%+, we believe asset quality would continue to a key factor. Maintain BUY with a revised TP of Rs 330 (1.3x FY16E ABV).''

Disclaimer: IRIS has taken due care and caution in compilation of data for its web site. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.