The Capital Raising Committee, a subcommittee of the board of YES Bank, India's 4th largest private sector bank approved the allotment of 53.5 million shares thus completing the highly successful qualified institutions placement raising USD 500 million (Rs 29.42 billion). The allotment of shares was done across 114 investors at Rs 550 a share.

The Capital Raising Committee, a subcommittee of the board of YES Bank, India's 4th largest private sector bank approved the allotment of 53.5 million shares thus completing the highly successful qualified institutions placement raising USD 500 million (Rs 29.42 billion). The allotment of shares was done across 114 investors at Rs 550 a share.

On the successful completion of the equity allotment, Rana Kapoor, MD & CEO said, ''YES Bank's USD 500 mn QIP is among the FIRST significant capital raising in India after the formation of the New Government. We are delighted that 114 marquee institutional investors including sovereign funds, long only funds, insurance and pension funds etc. have reposed their investor faith in the bank. We believe that the success of our QIP signals the renewed interest global investors have in high quality companies from India. As the economy is set to recover significantly under the leadership of the new government, this boost to our capital has ensured that YES Bank is well positioned to benefit from imminent growth opportunities in the future and achieve its vision of ‘Building the Best Quality Bank of the World in India by 2020.''

On the successful completion of the equity allotment, Rana Kapoor, MD & CEO said, ''YES Bank's USD 500 mn QIP is among the FIRST significant capital raising in India after the formation of the New Government. We are delighted that 114 marquee institutional investors including sovereign funds, long only funds, insurance and pension funds etc. have reposed their investor faith in the bank. We believe that the success of our QIP signals the renewed interest global investors have in high quality companies from India. As the economy is set to recover significantly under the leadership of the new government, this boost to our capital has ensured that YES Bank is well positioned to benefit from imminent growth opportunities in the future and achieve its vision of ‘Building the Best Quality Bank of the World in India by 2020.''

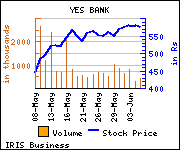

Shares of the bank declined Rs 6.9, or 1.19%, to settle at Rs 574.25. The total volume of shares traded was 410,649 at the BSE (Thursday).