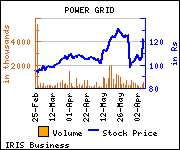

ICICIdirect has maintained 'Buy' on Power Grid Corporation of India with target price of Rs 148 as against current market price (CMP) of Rs 125, with upside potential of 18% in its report.

ICICIdirect has maintained 'Buy' on Power Grid Corporation of India with target price of Rs 148 as against current market price (CMP) of Rs 125, with upside potential of 18% in its report.

Commenting on the investment rationale, the stock broker said, ''Revenue increased 17.9% YoY to Rs 39.86 billion (in line with I-direct estimate: Rs 40.85 billion) driven by 15.9%, 73.3%, 39.3% YoY revenue growth across transmission, telecom, consultancy income, respectively

In Q4FY14, the company capitalized assets worth Rs 63.52 billion while it incurred capital expenditure of Rs 55 billion. For FY14, capitalization and capex amounted to Rs 159.04 billion and Rs 223.24 billion, respectively. Capitalization for FY14 was below our estimate of Rs 170 billion. However, the company capitalized further Rs 18.5 billion assets during the first week of April 2014. Factoring in the same, capitalization for the year was in line with our estimates

In Q4FY14, the company capitalized assets worth Rs 63.52 billion while it incurred capital expenditure of Rs 55 billion. For FY14, capitalization and capex amounted to Rs 159.04 billion and Rs 223.24 billion, respectively. Capitalization for FY14 was below our estimate of Rs 170 billion. However, the company capitalized further Rs 18.5 billion assets during the first week of April 2014. Factoring in the same, capitalization for the year was in line with our estimates

We believe PGCIL commands the best growth profile (earnings CAGR of 13% over FY13-16E) coupled with relatively least risky business model in the domestic utility universe. Although equity dilution has dented RoNW for FY14 to 13.1% from 16.1% in FY13, increased capitalization over FY13-14 would lead to increased RoE in FY15E and FY16E to 13.6% and 14.3%, respectively.

Furthermore, CERC's final verdict on tariff norm for FY14-19 is likely to have a marginal impact on earnings (1-2%). We expect strong capitalization over FY15E and FY16E at Rs 185.4 billion and Rs 182.8 billion, respectively, which would yield higher returns, going ahead. We have revised our target price upward to Rs 148 as we have rolled forward our valuations to 1.8x book value for FY16E. We maintain Buy rating.''

Disclaimer: IRIS has taken due care and caution in compilation of data for its web site. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.