State Bank of India (SBI), the largest public sector lender, today reported a fall of 7.83% in standalone net profit to Rs 30.41 billion for the quarter ended Mar. 31, 2014 as compared to Rs 32.99 billion in the same period last year.

State Bank of India (SBI), the largest public sector lender, today reported a fall of 7.83% in standalone net profit to Rs 30.41 billion for the quarter ended Mar. 31, 2014 as compared to Rs 32.99 billion in the same period last year.

Total income increased by 16.82% to Rs 424.43 billion for the quarter ended Mar. 31, 2014 as compared to Rs 363.31 billion in the same period last year.

Net NPA was at Rs 310.96 billion for the quarter ended Mar. 31, 2014, as compared to Rs 219.57 billion for the quarter ended Mar. 31, 2013, representing a sharp increase of 41.63%.

Net NPA was at Rs 310.96 billion for the quarter ended Mar. 31, 2014, as compared to Rs 219.57 billion for the quarter ended Mar. 31, 2013, representing a sharp increase of 41.63%.

Meanwhile in percentage term, net NPA increased to 2.57% as on Mar. 31, 2014 from 2.10% as on Mar. 31, 2013.

Capital adequacy ratio (CAR) under Basel III of the bank was at 12.44% as on Mar. 31, 2014.

Net Interest Income increased by 16.47% YoY from Rs 110.78 billion in Q4FY13, to Rs 129.03 billion.

Non Interest Income increased by 18.73% from Rs 55.47 billion in Q4FY13, to Rs 65.86 billion. Domestic NIM is stable at 3.49%.

Deposits of the bank increased from Rs 12,027.40 billion in Mar 13 to Rs 13,944.09 billion in Mar 14, a growth of 15.94%.

Savings bank deposits increased from Rs 4,149.07 billion in Mar 13 to Rs 4,692.62 billion in Mar 14 (13.10% YoY growth).

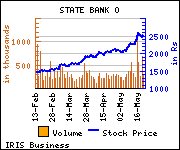

Shares of the bank gained Rs 169.3, or 6.74%, to trade at Rs 2,681.10. The total volume of shares traded was 890,781 at the BSE (2.09 p.m., Friday).