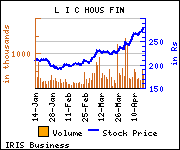

Edelweiss Securities has maintained 'Buy' on LIC Housing Finance with target price of Rs 333 as against current market price (CMP) of Rs 273 in its report.

Edelweiss Securities has maintained 'Buy' on LIC Housing Finance with target price of Rs 333 as against current market price (CMP) of Rs 273 in its report.

Commenting on the investment rationale, Edelweiss Securities said, ''LIC Housing Finance (LICHF) reported 17% YoY PAT growth (on a higher base set in Q4FY13) to Rs 3.7 billion - though in line with our expectation was ahead of consensus estimate. NIMs, after declining for three consecutive quarters, expanded sharply to 2.4% (with benefit flowing from 32bps fall in funding cost).

Commenting on the investment rationale, Edelweiss Securities said, ''LIC Housing Finance (LICHF) reported 17% YoY PAT growth (on a higher base set in Q4FY13) to Rs 3.7 billion - though in line with our expectation was ahead of consensus estimate. NIMs, after declining for three consecutive quarters, expanded sharply to 2.4% (with benefit flowing from 32bps fall in funding cost).

Asset quality was stable in non-individual portfolio with no incremental stress or resolution and in individual segment, has come off following seasonality. Modest disbursement growth in FY14 following strategy of profitable growth, coupled with relatively higher prepayment/repayment in Q4FY14, led to moderation in individual loan growth to 18%.

Release of provisioning towards dual rate loans and improved visibility on resolution of developer loans in the near term will keep credit cost muted. With banking licence overhang settled, we expect current business model to deliver 18% earnings growth and RoE of 19% over FY15-16E. Valuing at 1.7x FY16E P/ABV, we arrive at a target price of Rs 333. Maintain 'Buy'.''

Disclaimer: IRIS has taken due care and caution in compilation of data for its web site. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.