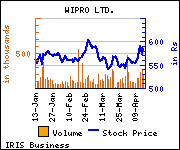

HDFC Securities has maintained 'Buy' on Wipro with target price of Rs 640 as against current market price (CMP) of Rs 588 in its report.

HDFC Securities has maintained 'Buy' on Wipro with target price of Rs 640 as against current market price (CMP) of Rs 588 in its report.

Commenting on the investment rationale, the stock broker said, ''Wipro's 4QFY14 results were in line at the topline but ahead of our estimates on the EBIDTA margin front. PAT was 8% ahead of our ests aided by strong margin beat.

However, Wipro's 1QFY15 USD revenue guidance for IT services remained modest at ((0.5)/2% QoQ decline/growth).This would mark the fourth sequential year of a softer 1Q, which could have implications for the full year's growth rate.

However, Wipro's 1QFY15 USD revenue guidance for IT services remained modest at ((0.5)/2% QoQ decline/growth).This would mark the fourth sequential year of a softer 1Q, which could have implications for the full year's growth rate.

We downgrade our FY15 USD revenue growth assumptions to 10% (vs.13% earlier). However, we expect Wipro's USD revenue growth for FY15 to show marked improvement from earlier years (USD revenue growth at 5/6.4% for FY13/FY14).

Wipro continues to deliver steep improvement in profitability aided by improving productivity and operational efficiencies.Net headcount declined for the third quarter in a row which has led to improved margin trajectory. Reasonable valuations (14.5x FY16E) and improving profitability leads us to remain bullish on Wipro. Our TP is retained at Rs 640/sh (16x FY15E). Retain Buy.' '

Disclaimer: IRIS has taken due care and caution in compilation of data for its web site. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.