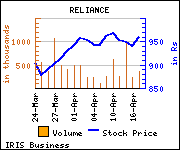

Religare Institutional Research has maintained 'Hold' on Reliance Industries (RIL) with target price of Rs 950 in its report.

Religare Institutional Research has maintained 'Hold' on Reliance Industries (RIL) with target price of Rs 950 in its report.

Commenting on the investment rationale, the stock broker said, "In line with our estimates, RIL's Q4FY14 PAT was flat QoQ/YoY at Rs 56.3 billion as stronger GRMs at USD 9.3/bbl offset lower other income of Rs 20.4 billion (-12% QoQ). Production at KG-D6 improved to 13.6mmscmd on connection of the MA-8 well (January 2014). Production is likely to average higher in FY15 on continued work-over operations. Crude and natural gas (NG) production at PMT however declined, leading to revaluation of Tapti reserves and expected early abandonment of the field by end-FY15. CBM development is on track with first gas likely in mid-FY16.

Commenting on the investment rationale, the stock broker said, "In line with our estimates, RIL's Q4FY14 PAT was flat QoQ/YoY at Rs 56.3 billion as stronger GRMs at USD 9.3/bbl offset lower other income of Rs 20.4 billion (-12% QoQ). Production at KG-D6 improved to 13.6mmscmd on connection of the MA-8 well (January 2014). Production is likely to average higher in FY15 on continued work-over operations. Crude and natural gas (NG) production at PMT however declined, leading to revaluation of Tapti reserves and expected early abandonment of the field by end-FY15. CBM development is on track with first gas likely in mid-FY16.

Petchem EBIT and margins at Rs 20.9 billion and 8.6% respectively were sequentially flat and muted due to weak domestic polymer demand growth of just 3% YoY (vs. a 10-year CAGR of 10.6%). However, the demand environment is expected to improve in FY15.

RIL has successfully commissioned a 400ktpa PFY plant at Silvassa and is expected to commission 9mmtpa of polymer and polyester capacities as part of its USD 12 billion capex program over FY15-FY16. We expect these expansion projects to support 11% earnings CAGR over FY14-FY16."

Disclaimer: IRIS has taken due care and caution in compilation of data for its web site. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.