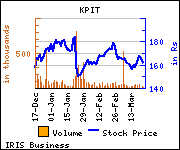

HDFC Securities has retained 'Neutral' on KPIT Technologies with target price of Rs 115 as against current market price (CMP) of Rs 161 in its report.

Commenting on the investment rationale, HDFC Securities said, ''KPIT cited of hiring senior resources to increase focus on verticalization of the business. Management indicated of planning to carve three major verticals-manufacturing, energy & utilities and automotive. Within manufacturing, the company intends to focus on sub-verticals like industrials, farm equipment, medical devices and heavy engineering.

The near term strategy is to increase mining in the strategic accounts by verticalization. For example: KPIT cited of cross selling business IT services to its automotive clients to increase revenue per account.

The near term strategy is to increase mining in the strategic accounts by verticalization. For example: KPIT cited of cross selling business IT services to its automotive clients to increase revenue per account.

KPIT's strong acquisition track record has enabled deliver robust USD revenue growth of 35% CAGR(FY11-FY13). However, we believe that FY14 has been a dismal year owing to its weak performance on both revenues and margins. We expect the company to deliver ~8.5% USD revenue growth for FY14E owing to softness in SAP services line as well as muted growth top client.

KPIT currently trades at an attractive valuation (8.3x FY16E EPS). Turnaround in growth in FY15E and improvement balance sheet could help in valuation re-rating. We retain our TP to Rs 175/sh (9x FY16 EPS). Retain Neutral.''

Disclaimer: IRIS has taken due care and caution in compilation of data for its web site. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.