India Ratings & Research (Ind-Ra) has affirmed Bharat Heavy Electricals (BHEL) long-term issuer rating at 'AAA' with a stable outlook.

India Ratings & Research (Ind-Ra) has affirmed Bharat Heavy Electricals (BHEL) long-term issuer rating at 'AAA' with a stable outlook.

The ratings continue to reflect BHEL's healthy cash balances of Rs 70 billion in 9MFY14, leading to a negative net adjusted debt. The company's liquidity position has remained comfortable despite a rise in debtors supported largely by customer advances, trade payables, cash balances and fund-based limits.

The ratings also reflect the moderation in the sector's competitive intensity with prices per MW largely stabilising. The competitive pressures from the Chinese and domestic players have reduced, however, given the limited orders from the central and state generating utilities due to the macro-economic environment, the pricing has not improved. In order to protect contribution margins in such a scenario, BHEL has been working towards indigenising components, de-packaging balance of plant (BoP) equipment and lean manufacturing.

The ratings also reflect the moderation in the sector's competitive intensity with prices per MW largely stabilising. The competitive pressures from the Chinese and domestic players have reduced, however, given the limited orders from the central and state generating utilities due to the macro-economic environment, the pricing has not improved. In order to protect contribution margins in such a scenario, BHEL has been working towards indigenising components, de-packaging balance of plant (BoP) equipment and lean manufacturing.

Order inflows improved to Rs 316 billion in FY13 from lows of Rs 221 billion in FY12 and are expected to be nearly Rs 300 billion in FY14 as the company has already won orders worth Rs 117 billion till 9MFY14. BHEL has emerged as the lowest bidder for orders totalling 3.2GW which are expected to be awarded in the near term. Ind-Ra estimates an order inflow of Rs 300 billion-Rs 350 billion annually over the medium term.

BHEL's order book has continued to suffer on account of delays in order finalisations on account of fuel linkage issues, weak financial health of state power utilities and the lack of project clearances. The order book at end-9MFY14 stood at Rs 1,006 billion down 37% from the peak of Rs 1,641 billion in 4QFY11.

Given that revenue bookings lag order bookings, the company’s revenue started declining only since 3QFY13 compared to the decline in the order book which had started in 3QFY12. With a book to bill ratio of 2.2x at end- 9MFY14, Ind-Ra expects revenue to decline in FY15. Around 20% of the order book is slow moving, which could further impact revenue. Also, the short-cycle orders from the industry segment have not been encouraging and could pressurise the revenue further. However, if the order inflows were to improve on account of the green shoots visible in the power sector, it could lead to an improved revenue profile in FY17.

According to Ind-Ra, BHEL's EBITDA margins could also come under pressure given the fixed nature of staff costs and other expenses. Moreover, orders booked during FY12 and FY13, which saw intense competitive pressure, could also lead to lower gross margins in the future years. However, BHEL has been trying to assimilate super-critical technology and control material costs which could protect gross margins to some extent.

BHEL’s revenues declined 15% yoy during 9MFY14, however debtors declined only marginally by 1.5% yoy to Rs 393 billion on account of the difficulties being faced by the private developers in obtaining funding. BHEL’s cash balances, access to fund based facility and management’s focus on resolution of such dues provides comfort.

The present ratings do not factor in any support from the government of India (GoI ownership was 67.72% in BHEL at end- 9MFY14), however, if BHEL’s standalone rating was to move lower than sovereign, support on account of the GoI ownership and its strategic importance can be incorporated into the ratings.

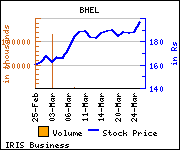

Shares of the company gained Rs 8.3, or 4.41%, to trade at Rs 196.50. The total volume of shares traded was 769,309 at the BSE (Tuesday).