Tata Consultancy Services (TCS) hosted an analyst briefing with Rajesh Gopinathan, CFO. The management indicated that overall demand remains good and in line with its expectations, with 1HFY15 growing faster than 2HFY15. This is expected to be led by the likely return of discretionary spending, increased penetration in Europe and that the company has not seen any ramp downs or cancelations in projects in recent weeks.

Tata Consultancy Services (TCS) hosted an analyst briefing with Rajesh Gopinathan, CFO. The management indicated that overall demand remains good and in line with its expectations, with 1HFY15 growing faster than 2HFY15. This is expected to be led by the likely return of discretionary spending, increased penetration in Europe and that the company has not seen any ramp downs or cancelations in projects in recent weeks.

Commenting on the analyst meet, Nomura Financial Advisory and Securities said, '' The commentary for FY15 remains unchanged, with management expecting FY15 to be better than FY14 on revenue growth. The company should report USD revenue growth of 16%+ in FY14F, based on our estimates.

Commenting on the analyst meet, Nomura Financial Advisory and Securities said, '' The commentary for FY15 remains unchanged, with management expecting FY15 to be better than FY14 on revenue growth. The company should report USD revenue growth of 16%+ in FY14F, based on our estimates.

TCS's 4QFY14 outlook on revenue growth is a tad below our expectation of 3% q-q growth, but FY15 outlook of revenue growth being better than FY14 is reassuring. Our current expectations build in USD revenue growth of 16.9% y-y in FY15F.

As well, after the recent disappointment at Infosys with the company guiding for a moderation in the growth outlook for 4QFY14 and 1HFY15, we believe TCS' outlook of no cancellations/ramp-downs, no vertical specific weakness and better discretionary outlook for FY15 reinforces our confidence in the underlying demand trends in the sector remaining strong.

We continue to see strong USD revenue CAGR of 16% and EPS CAGR of 18% over FY14-16F at TCS. We continue to prefer TCS over Infosys (INFO IN) within our Buy stocks.''

HCL Technologies, TCS and Tech Mahindra, followed by Infosys remain our pecking order of preference within the sector, within our Buy recommendations.''

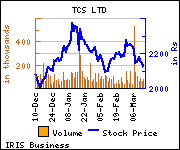

Nomura has recommended 'Buy' on Tata Consultancy Services (TCS) with target price of Rs 2,600 as against current market price (CMP) of Rs 2,122 in its report.

Disclaimer: IRIS has taken due care and caution in compilation of data for its web site. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.