Maruti Suzuki India said on Tuesday the board of directors has reviewed the Gujarat project. The board has decided to fund entire capex for the Gujarat Sub by depreciation and equity brought in by Suzuki Motor Corporation. ''In the event that both parties mutually agree to terminate the contract manufacturing agreement, the facilities of the Gujarat Sub would be transferred to Maruti Suzuki India at book value,'' the company said.

Maruti Suzuki India said on Tuesday the board of directors has reviewed the Gujarat project. The board has decided to fund entire capex for the Gujarat Sub by depreciation and equity brought in by Suzuki Motor Corporation. ''In the event that both parties mutually agree to terminate the contract manufacturing agreement, the facilities of the Gujarat Sub would be transferred to Maruti Suzuki India at book value,'' the company said.

Commenting on the same, the broking firm ICICIdirect said, ''We feel MSIL's management has done well to take on-board the concerns of minority shareholders. One of the major concerns was uncertainty on the 'mark-up' and how it would be changed possibly to fund the capex. The removal of this mark-up leaves a significant funding gap to be brought in by the parent Suzuki and not by MSIL. The book value transfer also overcomes concerns on higher payout for a company, which in letter and spirit has been only created for MSIL.

Commenting on the same, the broking firm ICICIdirect said, ''We feel MSIL's management has done well to take on-board the concerns of minority shareholders. One of the major concerns was uncertainty on the 'mark-up' and how it would be changed possibly to fund the capex. The removal of this mark-up leaves a significant funding gap to be brought in by the parent Suzuki and not by MSIL. The book value transfer also overcomes concerns on higher payout for a company, which in letter and spirit has been only created for MSIL.

We also feel the requirement of minority approval of three-fourth shareholders is a good step and will help generate trust between management and shareholders. We would await details from the management whether this entity will disclose financials at least annually to get an exact sense of the cost of production and whether this entity could become an associate company of MSIL as per new associate control rules of Companies Act 2013. We maintain our Hold rating with an enhanced target price of Rs 1,727.

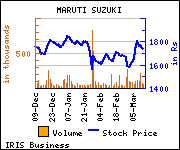

The stock broker has maintained 'Hold' on Maruti Suzuki India with target price of Rs 1,727 as against current market price (CMP) of Rs 1,860 in its report.

Disclaimer: IRIS has taken due care and caution in compilation of data for its web site. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.