Standard & Poor's Ratings Services (S&P) said today that it had affirmed its 'BB+' long-term issuer credit rating on India-based Indian Overseas Bank (IOB). The outlook is stable.

Standard & Poor's Ratings Services (S&P) said today that it had affirmed its 'BB+' long-term issuer credit rating on India-based Indian Overseas Bank (IOB). The outlook is stable.

"The rating affirmation reflects our expectation that a "very high" likelihood of timely and sufficient extraordinary support from the government of India will help IOB withstand continuing weakness in operating performance," said Standard & Poor's credit analyst Amit Pandey.

"The rating affirmation reflects our expectation that a "very high" likelihood of timely and sufficient extraordinary support from the government of India will help IOB withstand continuing weakness in operating performance," said Standard & Poor's credit analyst Amit Pandey.

IOB's aggressive growth over the past several years has stressed its internal control system, in our view. The bank's reported nonperforming loan (NPL) ratio rose sharply to 11% in Sept. 30, 2015, from 7.35% as of Sept. 30, 2014, and is the highest among the Indian banks.

"The bank's standard restructured ratio is also one of the highest, at 8.9%. Most of this restructuring took place during the past few years and we expect slippages to continue to occur in the restructured loan book. The resultant high credit costs have strained IOB's earnings, which remain abysmally low," he said.

The Reserve Bank of India, the country's central bank, initiated a "prompt corrective action" on IOB on Oct. 6, 2015, probably due to the bank's low earnings, which in turn are a result of its weak asset quality.

"IOB's weak operating performance and negative retained earnings have lowered the bank's capital ratios, which are close to the minimum regulatory capital requirement," said Pandey.

"The ratings on IOB could also face downward pressure if the prompt corrective action results in a weakening of the bank's business or credit profile. The probability of an upgrade of IOB over the next 12 months is remote, in our view," added Pandey

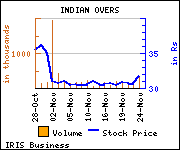

Shares of the company gained Rs 0.1, or 0.31%, to settle at Rs 31.85. The total volume of shares traded was 262,924 at the BSE (Thursday).