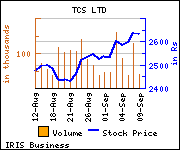

Nomura recommended Buy on Tata Consultancy Services for target Rs 2700 against current market price Rs 2643.

Nomura recommended Buy on Tata Consultancy Services for target Rs 2700 against current market price Rs 2643.

Commenting on the investment rationale stock broker said,"Management indicated that there was no change to the company's revenue growth outlook for FY15F. In 2Q growth rates across verticals are likely to see convergence. BFS will see better growth vs last quarter, while in Insurance the softness will continue. Growth rates at smaller verticals like media, travel, life sciences which had seen strong growth in 1Q is likely to see moderation in 2Q. Retail vertical will grow in line with the company average in 2Q.

Commenting on the investment rationale stock broker said,"Management indicated that there was no change to the company's revenue growth outlook for FY15F. In 2Q growth rates across verticals are likely to see convergence. BFS will see better growth vs last quarter, while in Insurance the softness will continue. Growth rates at smaller verticals like media, travel, life sciences which had seen strong growth in 1Q is likely to see moderation in 2Q. Retail vertical will grow in line with the company average in 2Q.

We see upside possibilities to FY15F revenue growth if India performs well in 2H (in line with seasonality). We continue to believe TCS remains best positioned to benefit from the demand upturn both from a cost efficiency as well as discretionary perspective."

Disclaimer: IRIS has taken due care and caution in compilation of data for its web site. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.