India Ratings and Research (Ind-Ra) has affirmed United Bank of India's (United) Rs 2 billion additional tier 1 (AT1) bonds (increased from Rs 1.5 billion) at long-term 'A-' with a negative outlook. Ind-Ra has also affirmed the bank's long-term issuer rating at 'AA-' with a stable outlook.

India Ratings and Research (Ind-Ra) has affirmed United Bank of India's (United) Rs 2 billion additional tier 1 (AT1) bonds (increased from Rs 1.5 billion) at long-term 'A-' with a negative outlook. Ind-Ra has also affirmed the bank's long-term issuer rating at 'AA-' with a stable outlook.

United's long-term issuer rating is driven by the agency's expectation of continued support from the government of India (GoI; 82% stake as of June 2015), given its significant market share in the previously unbanked and untapped regions of the north-eastern parts of the country. The rating of the AT1 bonds reflects United's weaker standalone credit profile relative to government banks'.

United's long-term issuer rating is driven by the agency's expectation of continued support from the government of India (GoI; 82% stake as of June 2015), given its significant market share in the previously unbanked and untapped regions of the north-eastern parts of the country. The rating of the AT1 bonds reflects United's weaker standalone credit profile relative to government banks'.

The government has supported United through regular equity injections since FY09, including Rs 7 billion in FY14. United also received Rs 3 billion common equity from the Life Insurance Corporation in FY15.

The bank also increased its equity by converting Rs 5.25 billion perpetual non-cumulative preference shares into equity shares which were allotted to GoI, increasing its stake to 82%. These conversions and infusions in FY15 helped the bank shore up its capital position, raising its common equity tier 1 (CET1) ratio to 7.52% in FY15 from 6.54% in FY14. However, the bank's CET 1 ratio stood at 7.16% in 1QFY16 due to robust risk weighted asset growth in the market risk category. The bank is seeking an additional Rs 5 billion capital from GoI.

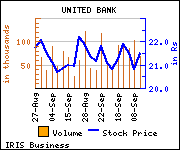

Shares of the bank gained Rs 0.2, or 0.9%, to trade at Rs 22.40. The total volume of shares traded was 40,887 at the BSE (1.45 p.m., Thursday).