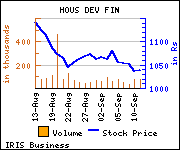

Hold HDFC; target Rs 1,056: ICICIdirect

Source: IRIS | 11 Sep, 2014, 06.05PM

|

|

|

|

|

| Rating: NAN / 5 stars. |

Comments | Post Comment Comments | Post Comment |

|

ICICIdirect recommended Hold on HDFC with target price Rs 1,056 against current market price Rs 1,050 in its report. ICICIdirect recommended Hold on HDFC with target price Rs 1,056 against current market price Rs 1,050 in its report.

Commenting on the investment rationale, the stock broker said,'HDFC has commanded premium valuations over the years due to its consistent track record in earnings and business growth. Return ratios have remained healthy across economic cycles with RoE >20% and RoA >2.5%. We expect this to be maintained over FY14-16E with stable asset quality. The consolidated PAT as on FY14 stood at Rs 79.48 billion with subsidiaries contributing 32%. Even consolidated RoEs have been healthy at ~21%. Commenting on the investment rationale, the stock broker said,'HDFC has commanded premium valuations over the years due to its consistent track record in earnings and business growth. Return ratios have remained healthy across economic cycles with RoE >20% and RoA >2.5%. We expect this to be maintained over FY14-16E with stable asset quality. The consolidated PAT as on FY14 stood at Rs 79.48 billion with subsidiaries contributing 32%. Even consolidated RoEs have been healthy at ~21%.

Over FY14-16E, we expect standalone earnings CAGR of 14% to Rs 70.13 billion. We revise our SOTP based target price to Rs 1,056 from Rs 1,000 earlier. We value the standalone housing finance business at 3x FY16E ABV (2.8x earlier) and maintain our Hold recommendation.'

Disclaimer: IRIS has taken due care and caution in compilation of data for its web site. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|