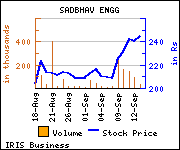

Emkay Research has recommended Buy on Sadbhav Engineering with revised target price to Rs 288 against market price of Rs 243 for medium to long term investment.

Commenting on the investment rationale, the stock broker said, "Company's funds raised to fuel growth, majority of which to be utilized towards working capital requirement. Large order backlog of Rs 84 billion with improvement in EBITDA margins, we expect earnings CAGR of 15% over FY14-16E.Equity investment is operational and enhances visibility of raising further growth capital at the SIPL level (road projects holding company), stake adjusted toll revenue CAGR of 38% over FY14-16E. Company is well placed to fund equity requirement of Rs 3.5 billion for BOT projects over FY14-16E by cash flows from the construction business, Arril securitization proceeds and dilution at the SIPL level."

Commenting on the investment rationale, the stock broker said, "Company's funds raised to fuel growth, majority of which to be utilized towards working capital requirement. Large order backlog of Rs 84 billion with improvement in EBITDA margins, we expect earnings CAGR of 15% over FY14-16E.Equity investment is operational and enhances visibility of raising further growth capital at the SIPL level (road projects holding company), stake adjusted toll revenue CAGR of 38% over FY14-16E. Company is well placed to fund equity requirement of Rs 3.5 billion for BOT projects over FY14-16E by cash flows from the construction business, Arril securitization proceeds and dilution at the SIPL level."

Disclaimer: IRIS has taken due care and caution in compilation of data for its web site. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided on its website.