Bharat Heavy Electricals (BHEL), the company has been successful in navigating through such a constrained business environment. BHEL has achieved a turnover of Rs 403.38 billion and a net profit of Rs 34.61 billion during 2013-14. The resilience of the company is evident from the net profit margin of 9% which is still higher than many industry peers. This was stated by B. Prasada Rao, chairman & MD, BHEL at the 50th annual general meeting of the company today.

Bharat Heavy Electricals (BHEL), the company has been successful in navigating through such a constrained business environment. BHEL has achieved a turnover of Rs 403.38 billion and a net profit of Rs 34.61 billion during 2013-14. The resilience of the company is evident from the net profit margin of 9% which is still higher than many industry peers. This was stated by B. Prasada Rao, chairman & MD, BHEL at the 50th annual general meeting of the company today.

Consequently, a total dividend of Rs 6.93 billion, has been declared for 2013-14, which is 141.5% of the paid-up capital (including an interim dividend of 65.5%), maintaining the track record of paying dividends uninterruptedly since 1976-77, he added.

Consequently, a total dividend of Rs 6.93 billion, has been declared for 2013-14, which is 141.5% of the paid-up capital (including an interim dividend of 65.5%), maintaining the track record of paying dividends uninterruptedly since 1976-77, he added.

Addressing shareholders, Rao said that, during the year BHEL synchronized/ commissioned all time high power projects of 13,452 MW which is the highest in a single year. This includes commissioning of 11,266 MW in utilities comprising 9 nos. of 600 MW sets, 1,698 MW in captive/industrial sets, and 488 MW in the overseas markets.

Rao said that despite unfavourable externalities, BHEL secured orders worth Rs 280.07 billion from its diversified business segments viz. Power and Industry covering both domestic and international markets. Despite severe market shrinkage and stiff competition in the power sector, BHEL increased its market share from 68% in 2012-13 to 72% in 2013-14 which includes highest ever mega EPC order worth Rs 79 billion for 3x660 MW supercritical units from NTPC for North Karanpura. At the end of the year total orders in hand for execution in 2014-15 and beyond, stand at Rs 1,015.66 billion.

He said that financial year 2013-14 was the second successive year of sub-5% growth, though the economy marginally improved as compared to 2012-13, with GDP growth of 4.7%. Persistent Inflation, high fiscal deficit and high interest rates have negatively affected the growth potential. The cutback in investments, slow momentum in infrastructure and energy sectors, delayed and stalled projects have also contributed to the performance that was below expectations. Investment and capital expenditure by the industry slowed down.

However, as the economy is expected to move at prerecession levels in near term, the capital expenditure cycle could kick off in a big way in the next few quarters. This will improve business environment and BHEL will benefit from emerging opportunities, he added.

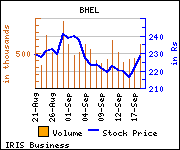

Shares of the company declined Rs 0.6, or 0.26%, to trade at Rs 227.85. The total volume of shares traded was 394,868 at the BSE (1.50 p.m., Friday).