ICICI Bank, the second largest private sector lender, reported on Monday a 10.18 rise in standalone net profit for the quarter ended Mar. 31, 2015. The bank has earned Rs. 29.22 billion, or Rs. 4.99 a share in the quarter, compared with Rs. 26.52 billion, or Rs. 4.57 a share for the same period last year. Analysts were expecting a profit of Rs 29.44 billion for the quarter.

ICICI Bank, the second largest private sector lender, reported on Monday a 10.18 rise in standalone net profit for the quarter ended Mar. 31, 2015. The bank has earned Rs. 29.22 billion, or Rs. 4.99 a share in the quarter, compared with Rs. 26.52 billion, or Rs. 4.57 a share for the same period last year. Analysts were expecting a profit of Rs 29.44 billion for the quarter.

Standalone total revenues during the quarter grew 12.23 percent to Rs. 162.35 billion from Rs. 144.65 billion in the previous year period.

Standalone total revenues during the quarter grew 12.23 percent to Rs. 162.35 billion from Rs. 144.65 billion in the previous year period.

Consolidated quarterly profit increased 13 percent to Rs 30.85 billion from Rs 27.24 billion in the same period last year.

Net interest income for the quarter rose 17 percent over the prior year period to Rs. 50.79 billion. Non-interest income for the quarter grew 17 percent over the last year period to Rs. 43.57 billion.

Cost-to-income ratio was 36.20 percent for the quarter, down from 39.20 percent for the previous year quarter.

The bank has made provision of Rs. 13.44 billion for loan losses during the quarter, up 88.24 percent from Rs. 7.14 billion in the same period last year. The provision coverage ratio was 58.6 percent at Mar. 31, 2015.

Net nonperforming assets registered a sharp rise of 91.61 percent or Rs. 30.24 billion to Rs. 63.25 billion on Mar. 31, 2015 from Rs. 33.01 billion on Mar. 31, 2014. Meanwhile, net nonperforming assets to total assets ratio stood at 1.40 percent in the quarter, up from 0.82 percent in the last year period.

The bank said capital adequacy at Mar. 31, 2015 as per Reserve Bank of India's guidelines on Basel III norms was 17.02 percent and Tier-1 capital adequacy was 12.78 percent, well above regulatory requirements.

Total advances stood at Rs 3,875.22 billion as on Mar. 31, 2015, up 14 percent compared with Rs 3,387.03 billion on Mar. 31, 2014. At the same time, total deposits went up 9 percent year-on-year basis to Rs. 3,615.63 billion as on Mar. 31, 2015.

The bank's CASA ratio improved to 45.5 percent at Mar. 31, 2015 from 42.9 percent at Mar. 31, 2014.

For the financial year 2015, standalone profit stood at Rs. 111.75 billion, up 14 percent from Rs. 98.10 billion in the last year. Net interest income increased 16 percent to Rs. 190.40 crore in fiscal 2015. Non-interest income rose 17 percent to Rs. 121.76 billion in financial year 2015.

Consolidated profit grew 11 percent to Rs 122.47 billion in fiscal 2015 compared to Rs 110.41 billion in the last year.

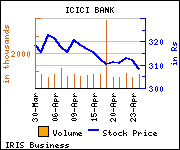

Shares of the bank declined Rs 5.2, or 1.69%, to trade at Rs 302.90. The total volume of shares traded was 2,129,778 at the BSE (3.22 p.m., Monday).